Robert Kiyosaki has issued a warning about a significant bubble in the market, spanning various assets. According to him, this bubble is bound to burst, and investors would be wise to protect themselves by investing in precious metals and cryptocurrencies.

“The recent post by X warned about a potential crash in the everything bubble, including stocks, bonds, and real estate. According to the post, the US debt is increasing by $1 trillion every 90 days, leading to the belief that the country is on the verge of bankruptcy. The author advised readers to protect themselves by investing in tangible assets such as real gold, silver, and Bitcoin.”

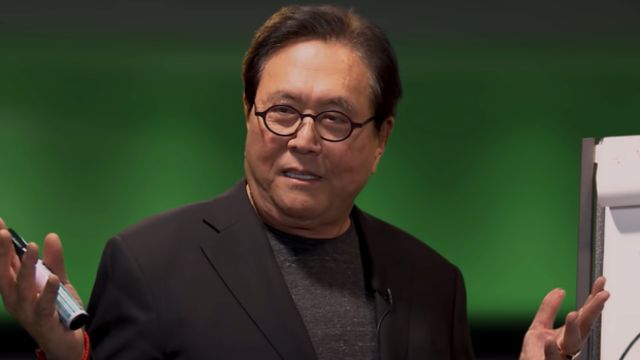

Robert Kiyosaki, the renowned author of “Rich Dad Poor Dad,” has long been known for his dire predictions and investment advice. His latest forecast and recommendations are in line with his previous warnings, as he continues to sound the alarm about an impending bubble burst. With a track record of accurately predicting market crashes, Kiyosaki’s insights are highly regarded by his followers. Additionally, he consistently stresses the importance of investing in his preferred assets as a means of safeguarding one’s financial future.

It is important to mention that the S&P 500 and Nasdaq Composite have reached record highs this year. The surge in these stock indexes can be attributed to the excitement surrounding AI and the optimistic belief that the Federal Reserve will begin reducing interest rates in the coming months.

Stubborn inflation and a strong job market have raised concerns that the Federal Reserve may maintain higher interest rates for an extended period. This could potentially impact stock market sentiment and lead to an increase in bond yields, resulting in lower bond prices.

The commercial real estate sector, burdened with debt, is facing a triple blow of declining asset values, soaring interest expenses, and a credit crunch caused by regional banks scaling back on lending to property owners.

House prices are currently at record levels, even as mortgage rates continue to rise. Consumers are feeling the impact of this through a combination of increased expenses such as food, fuel, and rent, as well as higher monthly payments on credit cards, car loans, and mortgages.

According to Kiyosaki, it is important to be cautious of inflated asset prices in the face of numerous challenges. He believes that gold and silver are better options than the dollar because their value is not susceptible to inflation, especially considering the increasing spending and escalating national debt of the US government.

Dave Ramsey, the personal-finance guru, has been an advocate for bitcoin on numerous occasions. However, it is important to highlight that he expressed a negative opinion about the popular cryptocurrency on his radio show in 2022, considering it to be worthless.

“I engage in bitcoin trading, but I personally don’t believe it holds any intrinsic value. For me, it’s more like a game that I enjoy playing,” he shared.

There is reason to approach the latest crash warning from the founder of The Rich Dad Company with skepticism, considering that his previous predictions have failed to materialize.

In the past, Kiyosaki has given some unconventional advice, like recommending that people stock up on trash bags and toilet paper during a period of high inflation in 2022. He also referred to canned tuna and baked beans as the “best investments” at that time due to their rapidly increasing prices.

But Kiyosaki was one of the few who had the foresight to recognize the impending trouble.

In March of last year, he confidently predicted that after Lehman Brothers, the next bank to face a similar fate would be Credit Suisse. His foresight proved to be accurate, as nearly a week later, UBS stepped in for an emergency takeover of the struggling Swiss bank.